Emerging Manufacturing Hubs: Why Southeast and South Asia are Winning Over Businesses

Southeast Asia and South Asia offer simple regulatory frameworks and higher growth potential, making them attractive alternatives to China for contract manufacturing operations. Key players in these regions include Thailand, Vietnam, and India, each presenting unique advantages.

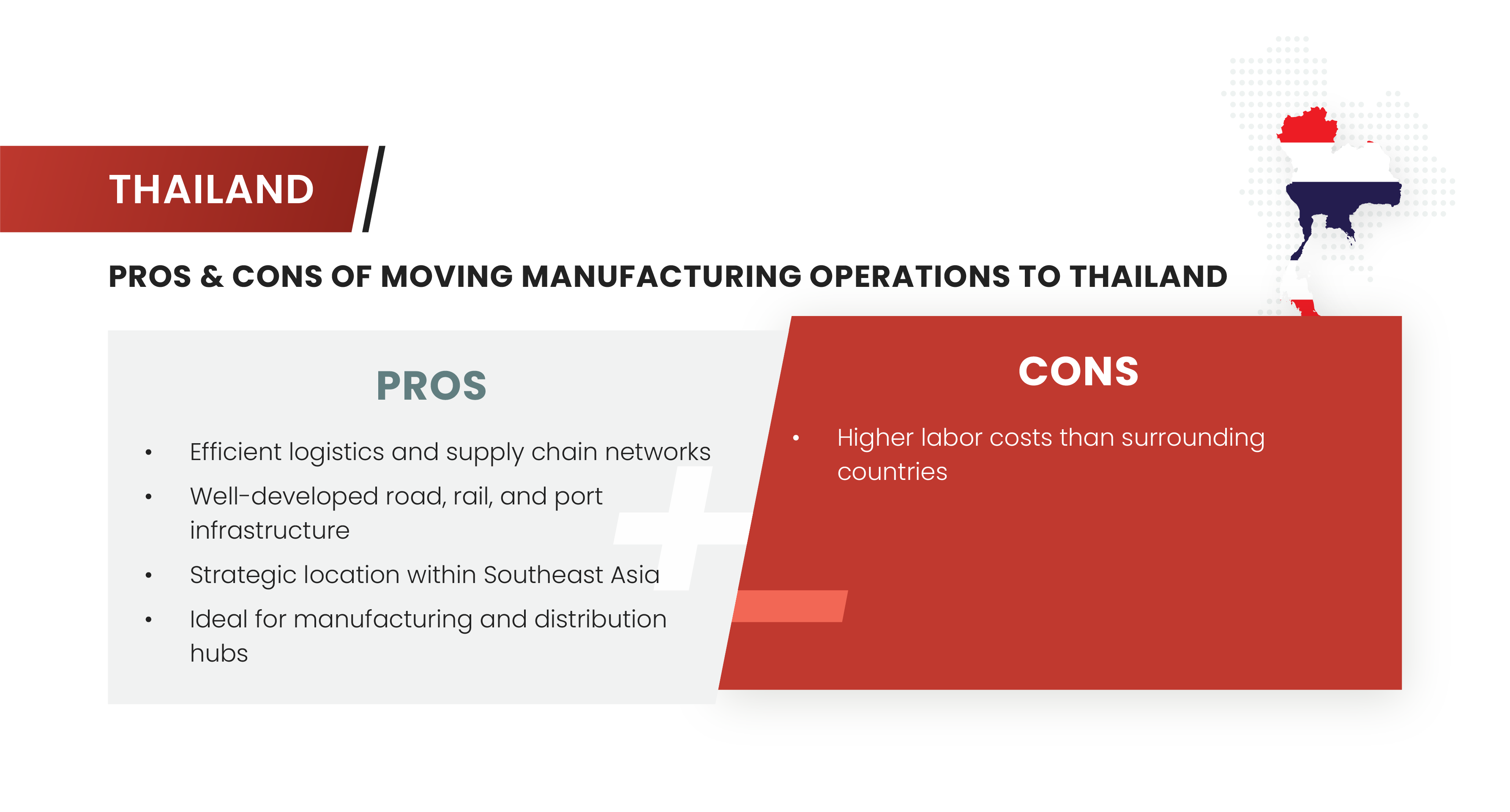

Thailand

Thailand is expected to see steady economic growth moving forward, with a projected GDP increase of 3.9% in 2024. This growth is driven by strong domestic consumption, a robust industrial base, and strategic initiatives like the Eastern Economic Corridor (EEC), which is aimed at transforming the region into a hub for advanced industries such as robotics, aviation, and biofuels.

Thailand is already a massive automotive hub, and has some of the longest established foundries and steel mills in the region. On the strength of this well-established manufacturing base, Thailand's industrial sector comprises approximately 35% of the national GDP.

Thailand also offers a favorable regulatory framework and numerous incentives for foreign investors. Its Board of Investment incentives let overseas companies enjoy tax exemptions, infrastructure support, and streamlined business registration processes, particularly in high-tech and advanced manufacturing sectors. These factors helped Thailand rank an impressive 21st out of 190 economies in the most recent Ease of Doing Business Index, highlighting its supportive business climate.

Concerns within Thailand’s industrial and technology community tend to revolve around the country’s education system, which is not especially well adapted to a culture of digital innovation. Still, Thailand’s current centers of advanced industrial production, powered largely by foreign investment, are helping a generation of talent gain experience and expertise in areas such as modern metal parts manufacturing methods.

Vietnam

The growing partnership between Vietnam and the US is now stronger than ever. Vietnam continues to attract substantial foreign direct investment, particularly in high-tech industries. With a projected GDP growth of 6% in 2024, the economy benefits from its competitive labor costs and strong manufacturing sector.

In 2023, Vietnam's FDI inflows reached $28.85 billion, marking a significant increase from previous years. Major tech companies, including Apple, are increasingly shifting production to Vietnam, enhancing its role as a manufacturing hub.

Vietnam boasts a young and expanding labor force, crucial for sustaining its manufacturing growth. Approximately 50% of Vietnam's population is under the age of 30, providing a robust workforce for technical industries and vocational trades. The country’s focus on improving educational standards and technical training ensures a competitive talent pool for the foreseeable future, with vocational training schools helping prepare the younger generation for careers in a variety of industries.

Vietnam has streamlined its business regulations and offers attractive incentives for foreign companies, including government-sponsored industrial estates and grants. The country’s trade agreements with major economies, such as the EU-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), enhance its business environment, making it easier for foreign companies to contract out their manufacturing bases.

Though current infrastructure is less than ideal for major shipments, Vietnam's commitment to improving such shortcomings and reducing regulatory burdens further boosts its attractiveness for investors.

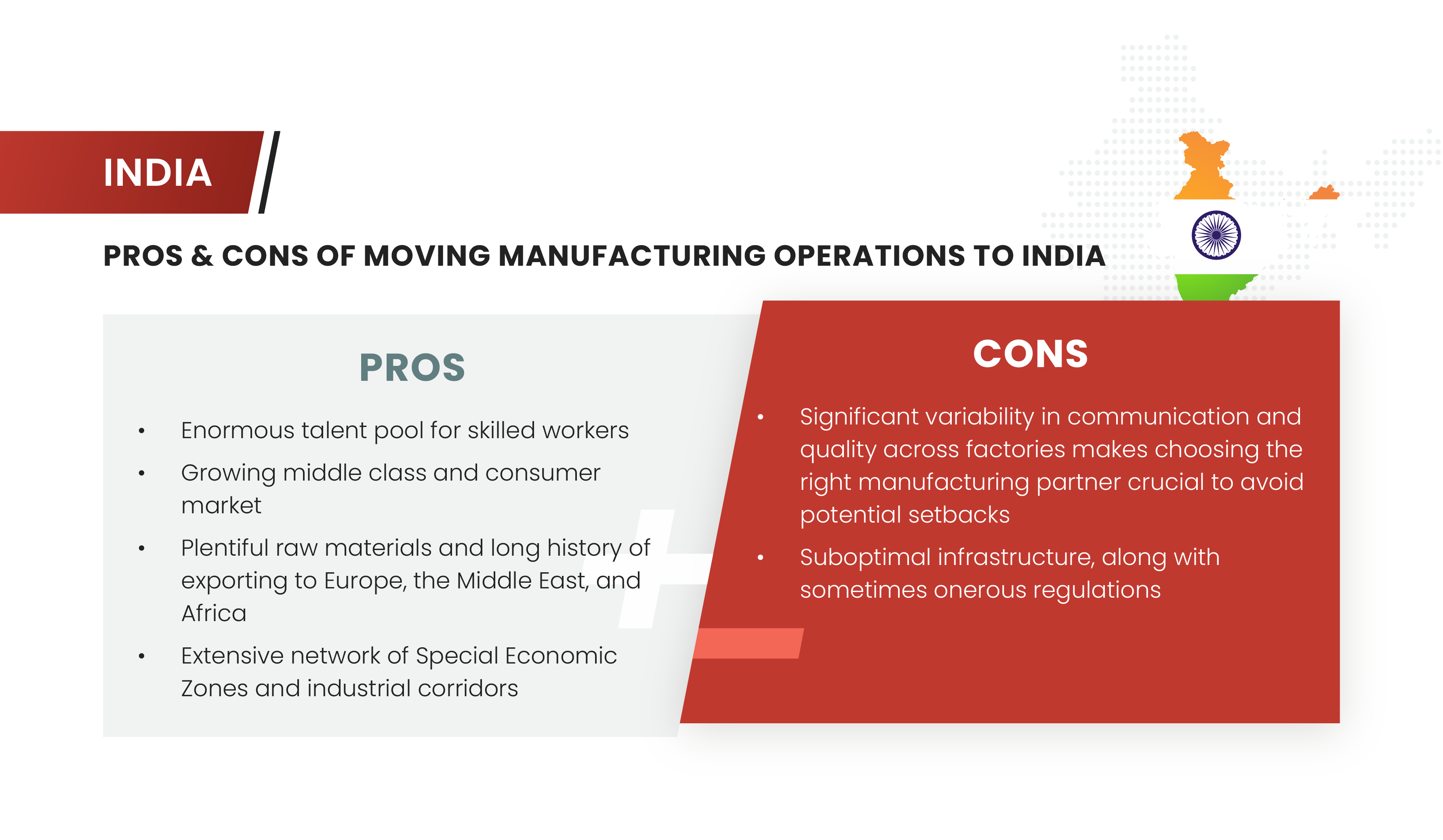

India

India stands out with its large, skilled workforce and significant market potential. Its GDP is expected to grow at a rate of 6.9% in 2024, supported by economic reforms and initiatives such as "Make in India", which aim to boost manufacturing capabilities and attract foreign investment. This strategic focus is particularly advantageous for businesses looking to establish or expand their component manufacturing operations.

India's industrial sector contributes about 31% to its GDP, with manufacturing alone accounting for over 18%. The country’s significant consumer base, including a growing middle class, further enhances its attractiveness for global businesses.

Although India and China have the two largest populations, the average age in China is 39 whereas in India it is just over 28. With more than 65% of its people under the age of 35, India boasts a vast and cost-effective labor pool. This demographic edge supports long-term economic growth and makes India an attractive destination for labor-intensive manufacturing operations. Additionally, India’s higher education sector is the third largest in the world, with over 43 million students enrolled in various universities and colleges, ensuring a continuous supply of skilled professionals.

In some circumstances, foreign companies aiming to buy land or operate factories themselves may find themselves facing bureaucratic delays. Contract manufacturing sidesteps most of these hurdles, letting domestic businesses benefit from simpler forms of oversight. Moreover, India has implemented significant reforms to improve its business climate, including easing regulations and reducing corporate tax rates. India ranks 63rd in the Ease of Doing Business Index, reflecting significant improvements in its regulatory environment.

Pioneering the Future of Manufacturing in Southeast and South Asia

As businesses globally reassess their manufacturing strategies, Southeast and South Asia emerge as pivotal regions. With their advantageous economic environments, strategic locations, and dynamic workforce, Thailand, Vietnam, and India not only offer compelling alternatives to China but are setting new standards in the manufacturing sector. These nations are proving to be not just viable, but superior choices for companies aiming to enhance their operational resilience and tap into burgeoning markets.

About Align Manufacturing:

Align Manufacturing, headquartered in Singapore and with offices in Bangkok, specializes in delivering high-quality industrial production solutions. Our expertise ranges from intricate sand casting and robust forging to efficacious stamping and state-of-the-art precision machining. This diverse capability ensures that we meet the complex needs of our clients with meticulous attention to detail and seamless communication. Partner with Align Manufacturing for efficient and precise manufacturing outcomes tailored to your project's success.

Note:

This article is part of an ongoing series exploring why US-based companies need to move their manufacturing operations outside of China.

To read the next article, click HERE.

To read the previous article, click HERE.

To download the entire series as a report, click the button below.